Automated Trading Strategies in Raka: Unleashing Grid Bots and Beyond

Raka introduces automated trading strategies designed to optimize trading efficiency and profitability in the Solana DeFi ecosystem. These strategies are powered by robust algorithms and designed to operate seamlessly on Solana’s high-throughput, low-latency blockchain. A standout offering is the Grid Trading Bot, along with other advanced bots tailored to handle various market scenarios.

Core Features of Raka’s Automated Trading Strategies

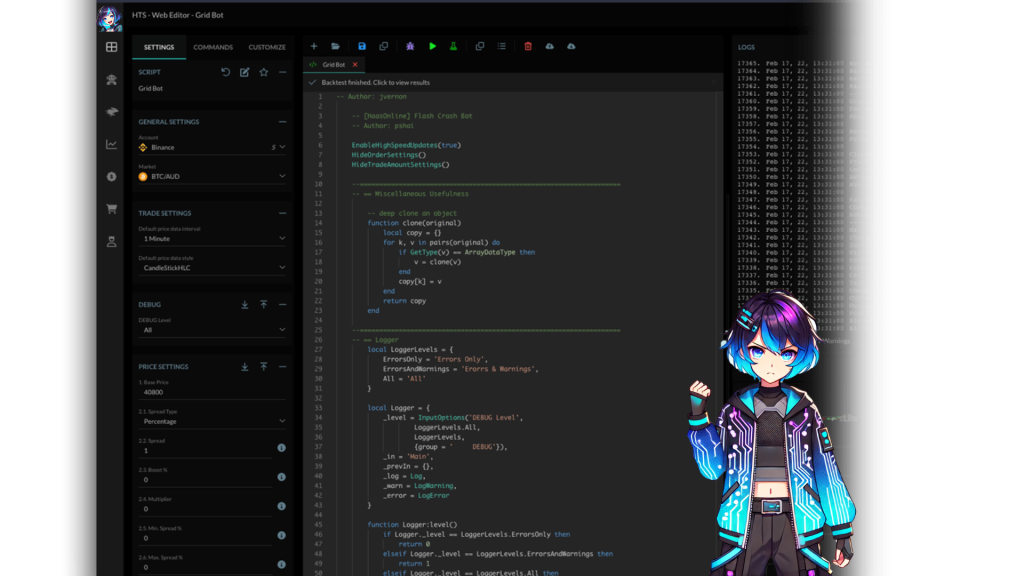

1. Grid Trading Bot

-

How It Works:

- The bot divides a predefined price range into multiple grids, executing buy orders at lower grid levels and sell orders at higher levels. This strategy thrives in sideways or moderately volatile markets.

- Users can customize parameters such as grid intervals, range limits, and investment allocation.

-

Advantages:

- Maximizes profits from small price fluctuations.

- Operates 24/7 without emotional biases.

2. Scalping Bot

-

How It Works:

- Executes quick trades to capitalize on minor price movements within seconds or minutes.

- Integrates real-time market data and low-latency execution to profit from high-frequency opportunities.

-

Advantages:

- Effective in high-volume, volatile markets.

- Ensures rapid order placement using Solana’s speed.

3. Arbitrage Bot

-

How It Works:

- Monitors price differences across multiple DeFi platforms (e.g., Serum, Orca, and Raydium) and executes trades to exploit arbitrage opportunities.

-

Advantages:

- Increases market efficiency while generating risk-free profits.

- Operates seamlessly across protocols using Solana’s interoperability.

4. Market Making Bot

-

How It Works:

- Provides liquidity by placing buy and sell orders at the market’s bid-ask spread.

- Balances liquidity provision with profit optimization.

-

Advantages:

- Stabilizes trading pairs and earns fees from transactions.

Complexity and Power of Raka’s Automated Trading

1. Blockchain Processing on Solana

- High Throughput: Solana’s network can handle 65,000 transactions per second (TPS), ensuring that Raka’s bots execute trades with minimal delay, even during peak market activity.

- Low Latency: With a block time of ~400 milliseconds, Solana ensures that trading strategies remain highly responsive to market changes.

- Challenges: The high-speed environment demands precise synchronization between off-chain computations (e.g., strategy simulations) and on-chain execution.

2. Computational Complexity

-

Grid Bot Complexity:

- Requires real-time tracking of multiple price levels, ensuring that buy and sell orders are dynamically updated.

- Incorporates algorithms like Dynamic Programming to adjust grid intervals based on market volatility.

-

Scalping and Arbitrage:

- Scalping relies on high-frequency data processing, requiring multithreaded computing to parallelize trade simulations and execution.

- Arbitrage involves graph-based shortest path algorithms to identify profitable routes across liquidity pools.

-

Market Making:

- Balances inventory management and profit margins using Monte Carlo simulations to predict price movements.

3. Machine Learning Enhancements

- Volatility Prediction: Uses Long Short-Term Memory (LSTM) models for time-series analysis of price data, improving bot performance in volatile markets.

- Behavioral Analysis: Leverages reinforcement learning to adapt trading strategies based on historical outcomes and market conditions.

4. Resource Requirements

-

Hardware:

- On-chain execution utilizes Solana’s validator network for scalability.

- Off-chain computations (e.g., machine learning training) require GPU acceleration, leveraging NVIDIA A100 GPUs or equivalent for real-time inference.

-

Software Stack:

- Core languages: Rust for on-chain programs, Python for algorithm development, and JavaScript/TypeScript for frontend integrations.

- Frameworks: TensorFlow or PyTorch for AI models, and Solana Web3.js for blockchain interaction.

Advantages of Raka’s Automated Strategies

- Scalability: Seamlessly handles thousands of concurrent trades without network congestion.

- Cost-Efficiency: Solana’s low transaction fees (<$0.01 per transaction) reduce operational costs for high-frequency strategies.

- User Accessibility: Intuitive interfaces allow users to customize strategies without requiring deep technical expertise.

- Resilience: Bots remain operational during extreme market volatility, ensuring continuity and reliability.

Raka’s automated trading strategies harness Solana’s unmatched speed and scalability to deliver precision-driven, profitable trading solutions. By combining cutting-edge algorithms with the blockchain’s robust infrastructure, Raka redefines what’s possible in DeFi trading automation.