Raka AI Agent White Paper

Empowering a Safer and Smarter Solana DeFi Ecosystem

Launch Date: January 27

Abstract

Raka AI Agent is an adaptive, intelligent risk management and trading system designed to enhance the security, efficiency, and profitability of the Solana DeFi ecosystem. By leveraging cutting-edge machine learning, real-time analytics, and decentralized governance, Raka introduces a suite of tools for risk assessment, automated trading, and market trend detection. This paper outlines the phased development of Raka, detailing its features, complexity, and roadmap.

Introduction

The rapid growth of DeFi on Solana has brought unparalleled opportunities for innovation and wealth creation. However, this growth comes with challenges like smart contract vulnerabilities, market volatility, and a lack of real-time risk management tools. Raka addresses these challenges by:

- Scanning for risks before they manifest.

- Providing automated trading strategies.

- Enabling decentralized governance for adaptive decision-making.

Core Features

1. Real-Time Risk Assessment

- Functionality: Continuously scans Solana’s DeFi protocols for vulnerabilities, including potential exploits, market fluctuations, and liquidity risks.

- Algorithm: Utilizes anomaly detection through machine learning models and volume analysis to flag risks early.

- Complexity: Requires high-speed processing to analyze terabytes of blockchain data in real time, relying on NVIDIA GPUs and optimized Solana RPC nodes.

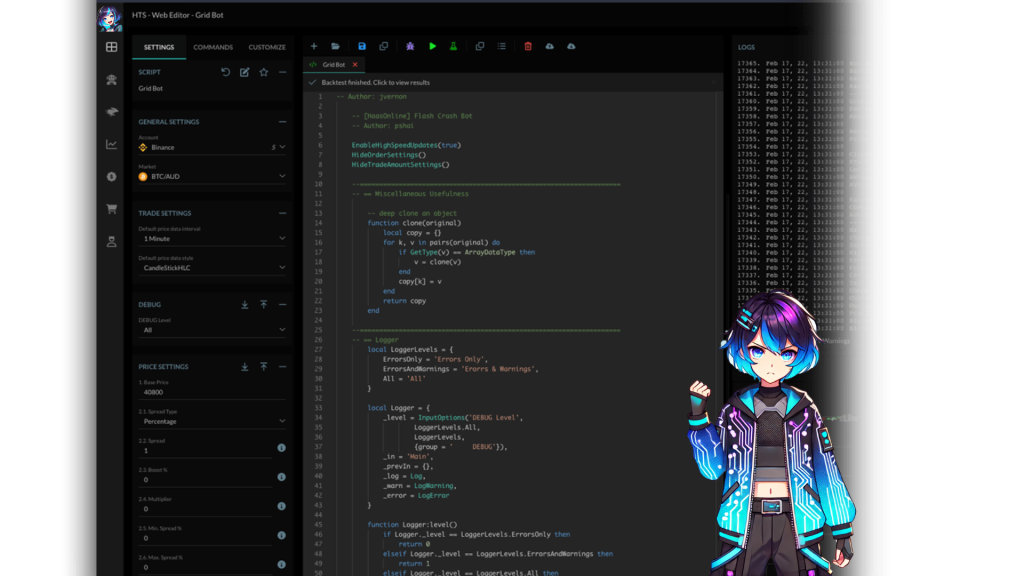

2. Automated Trading Strategies

- Functionality: Provides algorithmic trading solutions like grid-based strategies and automated liquidity rebalancing to maximize profitability.

-

Algorithm: Combines grid-based order placement, volume-weighted averaging, andRaka AI Agent White PaperEmpowering a Safer and Smarter Solana DeFi EcosystemLaunch Date: January 19AbstractRaka AI Agent is an adaptive, intelligent risk management and trading system designed to enhance the security, efficiency, and profitability of the Solana DeFi ecosystem. By leveraging cutting-edge machine learning, real-time analytics, and decentralized governance, Raka introduces a suite of tools for risk assessment, automated trading, and market trend detection. This paper outlines the phased development of Raka, detailing its features, complexity, and roadmap.IntroductionThe rapid growth of DeFi on Solana has brought unparalleled opportunities for innovation and wealth creation. However, this growth comes with challenges like smart contract vulnerabilities, market volatility, and a lack of real-time risk management tools. Raka addresses these challenges by:

- Scanning for risks before they manifest.

- Providing automated trading strategies.

- Enabling decentralized governance for adaptive decision-making.

- Complexity: Integrates low-latency order execution with Solana’s high-throughput capabilities to maintain consistent profitability.

3. BullSignal AI

- Functionality: Detects bullish patterns by analyzing buy-sell volume, chart patterns, and technical indicators.

- Algorithm: Employs Volume-Weighted Moving Averages (VWMA), candlestick pattern recognition, and machine learning for trend confirmation.

- Complexity: Balances real-time data processing with high-accuracy predictions, optimizing for low false-positive rates.

4. Decentralized Governance

- Functionality: Empowers Raka token holders to participate in governance, including voting on system updates and validating risk assessments.

- Algorithm: Uses a proof-of-stake (PoS) consensus mechanism integrated with a decentralized autonomous organization (DAO).

- Complexity: Ensures transparency and fairness through immutable on-chain voting records.

Phased Development Roadmap

Phase 1: Foundation (Q1 2025)

Phase 2: Expansion (Q3 2025)

Phase 3: Decentralized Governance and Token Launch (Q1 2026)

Phase 1: Foundation (Q1 2025)

- Objective: Develop the core AI engine and real-time risk assessment module.

-

Milestones:

- Launch initial smart contract vulnerability scanner.

- Integrate basic volume analysis tools for risk detection.

- Conduct beta testing with early adopters.

- Challenges: Ensuring data accuracy and real-time responsiveness.

Phase 2: Expansion (Q3 2025)

- Objective: Introduce automated trading strategies and advanced pattern detection.

-

Milestones:

- Deploy grid-based trading bots and BullSignal AI.

- Enhance risk detection with multi-layered AI models.

- Integrate alert systems with customizable thresholds.

- Challenges: Optimizing for low-latency execution on Solana’s blockchain.

Phase 3: Decentralized Governance and Token Launch (Q1 2026)

- Objective: Establish Raka’s decentralized governance model and token ecosystem.

-

Milestones:

- Launch Raka tokens with staking and reward mechanisms.

- Implement on-chain voting for governance decisions.

- Scale the ecosystem to support additional blockchains beyond Solana.

- Challenges: Ensuring wide adoption and seamless governance operations.

Technical Architecture

1. AI Processing Framework

- Powered by NVIDIA GPUs for high-speed computation.

- Implements TensorFlow and PyTorch for machine learning tasks.

2. Data Collection Layer

- Utilizes Solana RPC nodes to fetch real-time blockchain data.

- Employs decentralized oracles for external market data.

3. Smart Contract Layer

- Written in Rust and optimized for Solana’s high throughput.

- Includes modular components for easy upgrades and governance integration.

4. Governance Module

- Built on a DAO framework using smart contracts.

- Enables token-based voting and community participation.

Tokenomics

- Token Name: Raka Token ($RAKA)

- Utility: Governance, staking rewards, and ecosystem participation.

- Initial Supply: 1 billion tokens.

-

Allocation:

- 50% for ecosystem development and rewards.

- 30% for community incentives.

- 20% for team and partners.

Conclusion

Raka AI Agent is set to revolutionize the Solana DeFi landscape by combining robust risk management, intelligent trading solutions, and decentralized governance. With its phased development plan and community-driven approach, Raka aims to make DeFi safer, smarter, and more resilient. Join us on January 19 to be part of the future of finance.